Matt Wren Quoted In Atlanta Business Chronicle's Latest Buckhead Market Report

/Numerous High Rise Condo Buildings In Zip Code 30305 (Within Buckhead). ZIP CoDE 30305 also includes many lower density neighborhoods with primarily single-family detached homes.

I’m honored to share that I was recently quoted in the Atlanta Business Chronicle’s latest Buckhead Market Report, published September 12th, 2025. The article highlights important shifts in zip code 30305’s housing market, focusing on pending sales. You can read the piece here at Buckhead Market Report - August 2025.

A big thank you to the Atlanta Business Chronicle and to Janelle Ward for including my insights. Their reporting shines a light on the fast-moving dynamics of our market, and I’m grateful to be a part of the conversation.

Pending Sales In 30305

The Chronicle noted that pending home sales in 30305 dropped sharply in August 2025 - down about 31% compared to August 2024, marking the lowest August figure in more than a decade. That’s a significant data point and one worth watching closely.

When I dug deeper into the numbers, however, I found that August may not represent a steady downward trend. Here’s what I uncovered:

Not a straight-line decline: Pending sales in early 2025 were lower than in 2024, but in several months they actually increased year-over-year. The pattern alternated between up and down, rather than showing a clear slide.

Year-to-date perspective: Through August, pending sales in 30305 were down about 6% compared to the same period in 2024. That’s a softer decline than the August figure might suggest on it's own.

The Takeaway? August 2025 could be more of an outlier than the start of a larger slowdown trend. We’ll need to watch the next few months to see if that holds.

What This Means For Buyers & Sellers

From what I see:

For sellers under $2 million: the market remains competitive. Buyers are paying attention, and well-positioned homes are seeing good interest.

For higher-end homes (above $2 million): buyers are getting more negotiating power, especially with more supply in some of those luxury segments.

For both sides: pricing strategy, timing, condition, and neighborhood specifics are more important than ever. One zip code can behave differently than it’s neighbor, even within Buckhead.

Why This Matters & What’s Next

I believe articles like Janelle’s provide useful snapshots, especially for media, investors, and people tracking the market. What I want to help my clients and community with is nuanced understanding. On the Wren Atlanta Team, we help buyers and sellers understand their specific sub-market: what’s happening in your area, your price range, your kind of home. We will continue to monitor whether the August 2025-style drop in pending sales in zip code 30305 becomes recurring or remains a bump in the road.

Thank You

I’m grateful to the Atlanta Business Chronicle and to Janelle Ward for bringing these housing market conversations into the spotlight. As the data shows, the Buckhead market is competitive but nuanced, and keeping an eye on both short-term shifts and long-term patterns is essential.

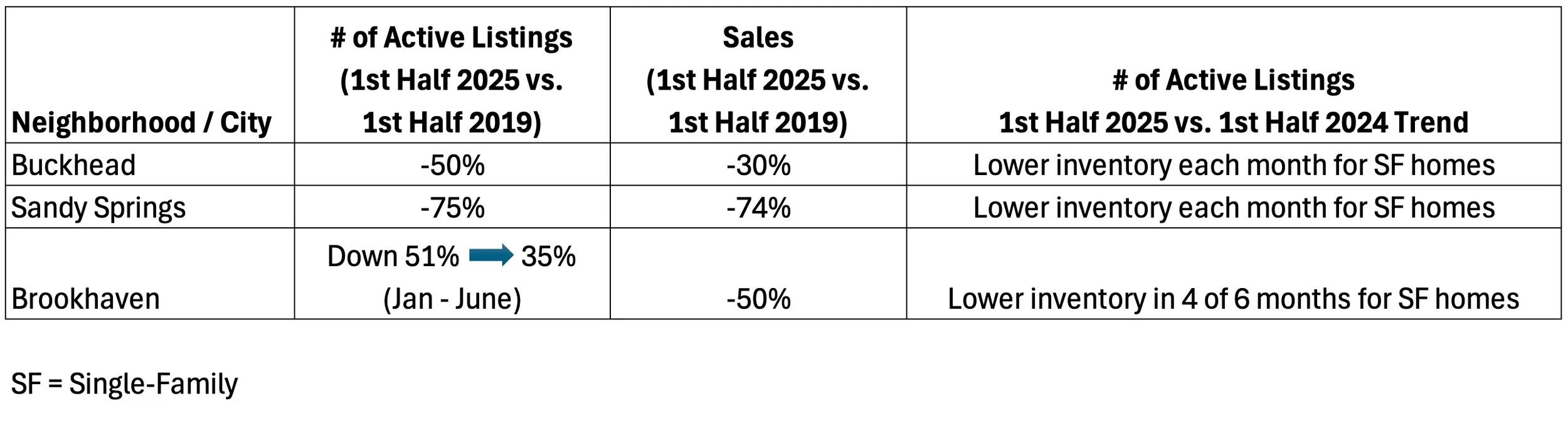

If you’d like more clarity on what the housing market trends are where you live in Buckhead, Sandy Springs, Brookhaven or elsewhere (or if you’d like help interpreting the trends) I’m always happy to share what I’ve found.

- Matt Wren